UK Mental Health Industry Overview

At Plimsoll we do company and market analysis differently. Our unique, continuously updated analysis simplifies the complexity of financial data and a subscription gives you a clear insight into the health, value and prospects of the 453 leading UK Mental Health companies , and how they sit in the overall market.

Based on the data available today, here are some key findings this analysis flagged:

- Acquisitions: 79 companies rated as “Highly Attractive”

- Benchmarking: 33 companies that are real up and coming threats

- Growth / New Business: 137 companies have grown by more than 10% in the latest year compared to 6.9% growth rates across the market

- Danger: 86 companies are serial loss makers while 221 companies are making the best profit

- Company Valuations: Get an instant valuation on 453 Mental Health companies showing who is up and who is falling

Exceeded Validation Views

You have exceeded your allowance of free views.

If you would like to contact us to discuss this matter you can do so on +44 (0) 1642 626 400

Other Industries in the Healthcare sector

You have come from the Mental Health Industry which is part of the Healthcare Sector

= Closest related Industries to the Mental Health Industry

- Care Homes

- Care Quality- Health & Social Care

- Children's Homes

- Cosmetic Surgery

- Dermatology

- Disability & Special Needs

- Fertility Clinics

- Foster Care

- Home Care Providers

- Live-In Care

- Mental Health

- Patient Transport

- Physiotherapy

- Private Hospitals & Clinics

- Retirement Homes & Villages

- Supporting Adults With Learning Disabilities

- Weight Loss Management

Sector List

You have come from the Mental Health Industry which is part of the Healthcare Sector

-

Healthcare

View Industries

Other Sectors

-

Agriculture & Forestry

View Industries -

Automotive

View Industries -

Beverages

View Industries -

Chemical

View Industries -

Cleaning

View Industries -

Construction

View Industries -

Cosmetics & Beauty

View Industries -

Education & Training

View Industries -

Electrical & Electronics

View Industries -

Energy

View Industries -

Environment

View Industries -

Fashion & Textile

View Industries -

Financial

View Industries -

Food

View Industries -

Furniture & Furnishings

View Industries -

Gardening & Landscaping

View Industries -

Glass

View Industries -

Heating, Ventilation & Air Conditioning

View Industries -

Hospitality & Travel

View Industries -

Industrial Goods & Services

View Industries -

Information Technology

View Industries -

Legal

View Industries -

Marketing, Advertising & PR

View Industries -

Media, Broadcasting & Performing Arts

View Industries -

Metals

View Industries -

Miscellaneous

View Industries -

Paper, Printing & Packaging

View Industries -

Pet Care

View Industries -

Professional Services

View Industries -

Property

View Industries -

Publishing

View Industries -

Retail

View Industries -

Scientific & Technical

View Industries -

Security

View Industries -

Sports & Leisure

View Industries -

Transport

View Industries -

Utilities

View Industries

Acquisitions

The Plimsoll Analysis is continuously updated to keep you up to date with the latest, most attractive acquisitions targets in the market. The following is a breakdown of the 79 best targets currently identified by turnover:

Acquisition targets by size

Right now, directors of other companies are using a Plimsoll Analysis to find the best takeover targets in your market. In fact, the analysis has named 79 highly attractive targets that you need to look at first. The interactive nature of the analysis means you can instantly pick:

- 79 companies rated as “Highly Attractive”

- 333 rated as “Worth Considering”

- The best takeovers by region

- Targets by size

- Companies that you already have your eye on

- New takeover options as new data becomes available

- High growth / high takeover

Each company in the Plimsoll Analysis is rated on their attractiveness for takeover. A 9-point checklist is provided on each company to determine their attractiveness and this is presented in a simple "fuel gauge" style measure. The higher the gauge the more attractive the company.

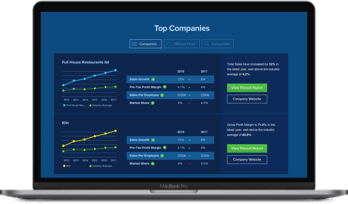

Benchmarking

The Plimsoll Analysis lets you benchmark your business performance against the competition and up to the minute industry metrics - all based on the continuously updated company data we receive. The following chart shows this weeks benchmarks in the Mental Health industry

How do you compare to other Mental Health companies? Are you one of the best or do you aspire to join them? The Plimsoll Analysis gives you instant benchmark of your company alongside the other 452 leading Mental Health companies.

With an individual analysis and assessment on each company and a comprehensive industry overview complete with league performance tables, you will be able to instantly see:

- Where you sit in an industry averaging 6.9% growth and 2.5% profits

- The companies you are beating and the others outperforming you

- Performance targets you need to achieve to move up the rankings

- 33 companies that are real up and coming threats

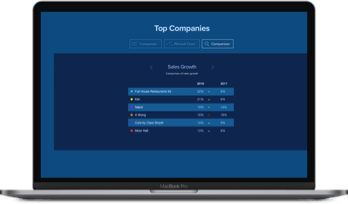

Growth / New Business

The following chart shows the companies grabbing all the growth and those in decline, based on the latest data available.

Industry Sales Growth

With average growth in the UK Mental Health market reaching 6.9% in the latest year, the Plimsoll Analysis can help you benchmark your own growth, spot those achieving better and help formulate your next move.

Be the first to see who is achieving great success and which competitors are in decline including:

- 137 companies have grown by more than 10% in the latest year

- 6.9% growth rates across the market

- 142 companies are selling less than last year

- 270 companies have seen sales increase

Danger

The following chart shows the latest breakdown of ratings that the Plimsoll Analysis is currently showing:

As a further sign of the intense competition within the UK industry, 86 companies continue to sell at a loss for the 2nd year running. These serial loss makers are adding to the congestion in the market, often undercutting the rest of the market and driving down profit margins across the board.

The Plimsoll Analysis provides an individual financial assessment on each company and will alert you instantly to how financially stable each company is. You will see:

- 221 companies that are making the best profit

- 137 that are high growth businesses changing the market

- 142 companies that are in decline

- 112 companies in danger

- 168 companies adding the most value

Valuations

How about the ability to instantly compare your valuation to the latest valuations of 452 other Mental Health companies? The following charts show how company values have changed over the last 5 years.

Average change in value across the industry

Here are a few of the latest valuation based findings that have been flagged based on the most recent data:

- 60 companies have lost more than a quarter of their value in their latest year

- 168 companies are worth more than a year ago

- Average values are up more than 7% this year

Valuations are changing constantly as new financial data becomes available. You'll have access to an instant valuation on 453 Mental Health companies showing who is up and who is falling. The analysis also provides a valuation for each of the previous 4 years and also a "future year" showing what it could be worth.

The Plimsoll Analysis provides an individual financial and commercial appraisal of every company in any UK market. It provides intelligence and insight not available anywhere else and will change your opinion on companies you know and introduce you to interesting companies you were previously unaware of. The Plimsoll Analysis will show you:

- If a company is strong or heading for trouble

- If the value of the company is rising or falling

- How attractive the company would be for acquisition

- If they are turning their investments into higher growth and profits

- If new directors have enhanced the company's performance

- If the debts of the company are becoming a problem

- If they are continuing to chase sales despite falling profits

- If they are getting the most from their resources

The same model of analysis is provided on each company in a market. You will be able to compare the performance of any company in your market instantly and monitor key trends. You will also receive the following on each company:

- Breakdown of key board members

- Primary trading address

- All main shareholders

- List of subsidiaries

The Plimsoll Analysis also provides a top-level view of what is happening in the market. This section of the analysis will alert you to the changing nature of performance across the industry including:

- The overall size of the market

- The latest performance ranking tables (including growth, size, profitability and much more)

- The difference between small and large companies

- The latest industry benchmarks for profitability and growth

Want to know which companies have been included in the Plimsoll Analysis? Simply enter your details and we will send you a complete list of the companies individually analysed and valued in this Plimsoll Analysis:

We have an editing team with decades of experience who compile the companies that are included in the Plimsoll Analysis. We use a variety of sources to validate the accuracy of the list including Companies House, company websites, trade associations, search facilities and, of course, customer recommendations. If you want to add additional companies to your Plimsoll Analysis we can do that for you at no extra cost.

As we provide the analysis in our online format TALAT, our results are linked to those filed at Companies House. This data is fed into our analysis live so you have the latest analysis and valuations on each company in the market each time you consult the analysis.

In this Plimsoll Analysis, each company is individually analysed using the Plimsoll Model. This unrivalled model measures the performance of any company, large or small, showing trends over time, and has been the cornerstone of Plimsoll's unique analysis for more than three decades. Used by some of the world’s largest companies, a Plimsoll Analysis gives instant comparative analysis of every company in any market. The model uses a series of intuitive charts and brief text-based summaries to highlight the key areas of interest in each company’s performance. Each company is also valued and rated on their takeover attractiveness.

The data used for the Plimsoll Analysis is continuously updated via our live data feed. The Plimsoll Model of analysis on any company is guaranteed to be based on the latest financial data available today.

A comprehensive analysis of the latest trends in the market is also included so you see how the performance of a group of individual companies changes the direction of the market. In this section of the analysis, you will see performance ranking tables for growth, profitability and more, a breakdown of the latest industry averages and other key measures so you can put company performance into context.

The ranking tables and averages are changing continuously as we receive more up to date data. The Plimsoll Analysis is the only way for you to keep up with the latest developments across your market.

It couldn't be easier. The founder of Plimsoll developed the model so that all directors had a means of understanding a company's health and prospects – not just those with an accounting qualification. He knew that everyone could benefit from spotting companies that are heading for danger, those growing rapidly but suffering low margins, those most likely to fail and much more. Using a series of easy to understand, clearly labelled charts and simple written summaries he developed a model that empowered its reader and gave an instant opinion on every company from the large multinational to the tiniest operation. With the analysis being delivered in our online, interactive format, we can also ensure we keep you up to date with the latest changes in the market with continuously updated analysis.

We encourage all our clients to take advantage of our free demo service. One of our product specialists is on hand to provide a complete product demo to help you get the most from your Plimsoll Analysis. The online nature of our analysis also contains walkthrough guides to help you to get even more value and insight.

The Plimsoll Analysis is provided online in our exclusive format TALAT – Take A Look At That. Continuously updated to give you the most up to date view of individual companies and the wider market, our unique format of analysis includes a host of interactive features including:

- Ability to filter companies by size, region, growth, profitability, best acquisitions and much more

- Constantly updated company and industry analysis

- "Your Own" mini reports looking just at companies important to you

- Over 35 different categories of company performance at a click

- Synopsis and in-depth analysis and valuation on every company in the market

- Regional analysis showing companies in different parts of the UK

- Special Insight Reports – each month you will have access to in-depth studies on key developments in the market. Recent studies include "What is happening to values in the market?” and “Why Productivity is important to your competitiveness”

- Unlimited PDF report downloads

The analysis is linked to a live feed of constantly updated financial data. Every time you visit your Plimsoll Analysis you will have the most up to date valuation and performance analyses on any company and the latest snapshot on the key developments in the market.

For more than three decades our clients have used the Plimsoll Analysis to:

- Benchmark their own business performance

- Monitor their competition

- Reset their strategy goals in core markets

- Look for acquisition opportunities

- Assess business development and growth opportunities

- Vet trading partners

- Follow the trends in key markets

- Look in other markets for customers or suppliers

You can pay by credit card or if you prefer, we will invoice you and send a secure payment link to make payment. We accept all major credit cards and bank transfers.

The Plimsoll TALAT industry analysis is a subscription product but you are not committed to anything beyond the initial period of access that you purchased. We do not terminate your access at the end of that period without your permission because many of our customers personalise their analysis and we wouldn’t want you to lose your favourites and personal reports. Your access to the Plimsoll analysis will automatically renew after your initial period but can be cancelled at that time if you no longer wish to continue with us- no questions asked.